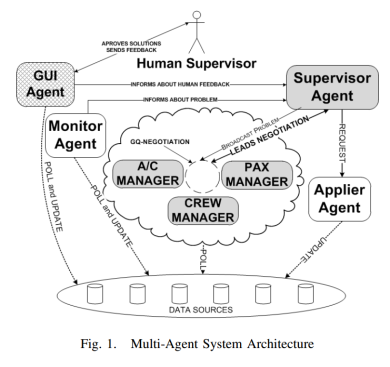

An airline operations control center (AOCC) is the focal point of all operations. It is an environment that includes different decision-making entities like the PAX Manager, Crew Manager, A/C Manager, Operations Superviser, etc. The interaction between these entities requires processes and the decisions taken must utilize all pertinent information. The following are the processes and resources that need to be considered when taking operational decisions in real-time.

1) Operation Monitoring: The flights are monitored to check if anything is not going according to the plan. The same happens in relation with crew members, passenger check-in and boarding, cargo and baggage loading, etc.

2) Take Action: If an event arises, such as, a crew member being late or an aircraft malfunction, a quick assessment is performed to check if an action is required. If not, the monitoring continues. If an action is necessary then there is a problem that needs to be solved.

3) Generate and Evaluate Solutions: Having all the information regarding the problem the AOCC needs to find and evaluate the candidate solutions. Usually, a sequential approach is adopted when generating solutions. First, the aircraft problem is solved. Then, using this partial solution, the crew problem is solved and, finally, using the previous solutions the passenger problem is also solved. It is understandable that the AOCC adopts this approach. Without good computer tools, it is difficult to handle the problem, considering the three dimensions (aircraft, crew and passengers) simultaneously. Although there are several costs involved in this process, we found that the AOCC relies heavily on the experience of their controllers and in some rules-of-thumb that exist on the AOCC.

4) Take Decision: Having the candidate solutions a decision needs to be taken.

5) Apply Decision: After the decision was taken, the final solution needs to be applied in the environment, that is,

the operational plan needs to be updated accordingly. An example of a solution to be applied is: exchange aircraft

between two flights, call a reserve crew member to replace an absent one and send a disrupted passenger in another

flight.

Crew Costs: the average or real salary costs of the crew members, additional work hours and per diem days to be paid, hotel costs and extra-crew travel costs.

Flight Costs: airport costs (approach and taxiing taxes), service costs (cleaning, handling and line maintenance services, etc.), average maintenance costs for the type of aircraft, ATC en-route charges and fuel consumption.

Passenger Costs: passenger airport meals, passenger hotel costs and passenger compensations. Finally, there is a less easily quantifiable cost that is also included: the cost of delaying or cancelling a flight from the passenger point of view. Most airlines use some kind of rule-of-thumb when they are evaluating the impact of the decisions on passengers. Others just assign a monetary cost to each minute of delay and evaluate the solutions taking into consideration this value.

In a fast-paced decision-making environment like an AOCC, it is critical to use all available resources at hand to make the most optimal decision, every one of which affects the financial bottom line of an airline.